December 14, 2024 - BY Admin

December 14, 2024 - BY Admin

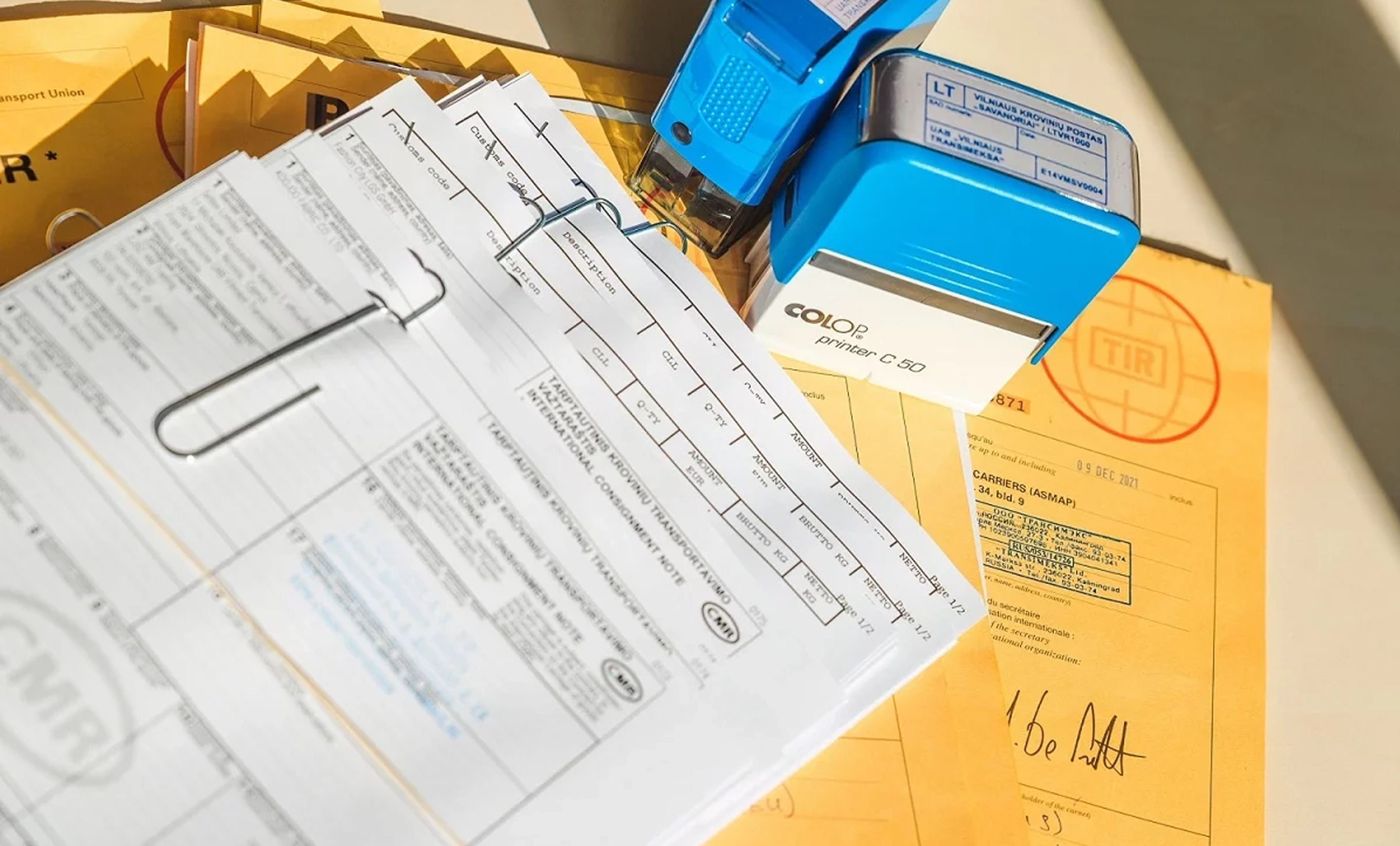

Navigating the customs clearance process in Dubai requires careful attention to detail and compliance with regulatory requirements. Importers and exporters must obtain various approvals, permits, and certifications from Dubai Customs to facilitate the smooth movement of goods across borders. In this guide, we'll explore the key approvals required in Dubai Customs and the procedures involved in obtaining them.

1. Import and Export Approvals:

Customs Declaration: Importers and exporters are required to submit a customs declaration to Dubai Customs for each shipment entering or leaving the country. The declaration provides details about the goods being imported or exported, including their description, value, quantity, and origin.

Import License: Certain goods require an import license from the relevant regulatory authority before they can be imported into Dubai. Examples include pharmaceuticals, food products, chemicals, and electronics. Importers must obtain the necessary licenses or permits to ensure compliance with regulatory requirements.

2. Value Added Tax (VAT) Registration:

VAT Registration: Businesses engaged in importing or exporting goods in Dubai may be required to register for Value Added Tax (VAT) with the Federal Tax Authority (FTA). VAT registration is mandatory for businesses meeting the specified turnover threshold and is necessary for compliance with VAT regulations.

3. Special Approvals and Certifications:

Certificate of Origin: Some countries require a Certificate of Origin to verify the country of origin of imported goods. This document may need to be certified by a chamber of commerce or other authorized entity before it can be submitted to Dubai Customs.

Phytosanitary Certificate: Agricultural products, plants, and seeds may require a phytosanitary certificate to certify that they are free from pests and diseases. This certificate is issued by the agricultural authorities in the exporting country and must be presented to Dubai Customs upon importation.

4. Procedures for Obtaining Approvals:

Documentation: Importers and exporters must ensure that all required documentation, including invoices, packing lists, certificates, and permits, is prepared and submitted accurately and in accordance with Dubai Customs' requirements.

Online Services: Dubai Customs provides online services and electronic platforms for submitting customs declarations, obtaining permits, and processing approvals. Importers and exporters can utilize these digital platforms to streamline the customs clearance process and reduce processing times.